Antitrust Violations in Real Estate: Common Practices and Legal Implications

Understand antitrust laws in real estate

The real estate industry operate under strict antitrust regulations design to maintain fair competition and protect consumers. These laws prohibit activities that restrain trade or create monopolies. When real estate professionals engage in anticompetitive behavior, they not merely harm consumers but besides risk severe legal consequences include substantial fines and yet imprisonment.

The Sherman antitrust act, the Clayton act, and the federal trade commission act form the foundation of antitrust enforcement in the United States. These laws apply direct to real estate transactions and the conduct of brokers, agents, and industry organizations.

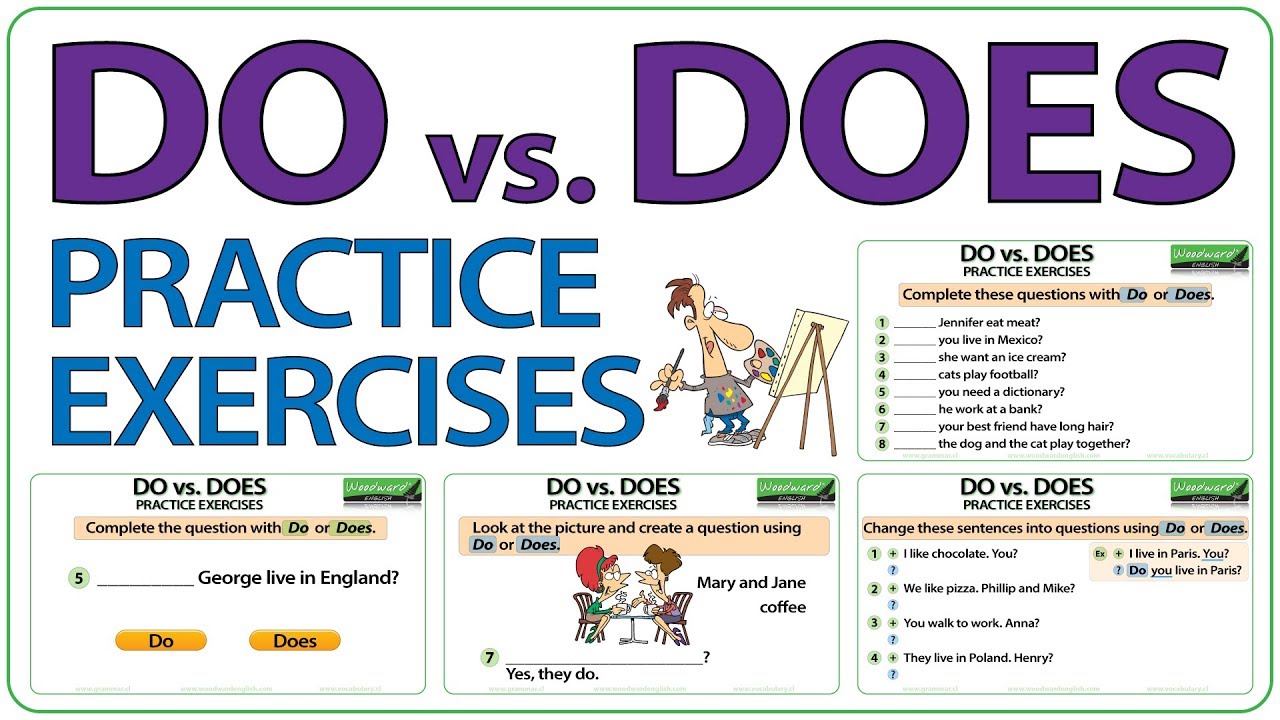

Price fixing: a prevalent antitrust violation

Peradventure the virtually common antitrust violation in real estate is price fixing. This occurs when competitors agree to set prices quite than allow market forces to determine them course.

Commission rate collusion

A classic example of price fixing in real estate involve brokers collude to maintain standard commission rates. For decades, the industry operates with anunderstandingd 5 6 % commission structure split between listing and buyer’s agents. This practice come under intense scrutiny in the landmark case of

Sitter / Burnett v. National association of realtors ®

, where a mMissourijury find that nnearand several major brokerages had conspire to unnaturally inflate commissions.

The evidence show that brokers had conjointly maintained the fiction that seller pay buyer agent commissions wernon-negotiablele, efficaciously prevent competition on commission rates. Th$1 1.8 billion verdict in this case has essentiallychangede how the industry approach commission structures.

Commission rate discussions

Regular casual conversations among compete brokers about” standard rates ” r “” rates ” ” constitute antitrust violations. For example, when brokers from different firms discuss at industry events what they typically charge, they risk create an impression of collusion.

In the

United States v. Foster

Case, a group of real estate professionals face charges for discuss maintain commission rates at association meetings. The court find that these discussions constitute illegal price fixing evening without a formal agreement.

Group boycotts and refusals to deal

Another common antitrust violation involve group boycotts, where competitors agree to refuse service to certain individuals or businesses.

MLS access restrictions

Multiple listing services (mMLS)have been at the center of numerous antitrust cases. When establish brokers use mlMLSules to disadvantage discount brokers or new market entrants, they may violate antitrust laws.

In

United States v. Realty multi list, inc.

, the court ffindsthat a mMLShad ccreatedunreasonable barriers to membership that efficaciously exclude discount brokers. The MLS had required new members to maintain a physical office and meet minimum experience requirements that serve no legitimate purpose beyond limit competition.

Boycott discount brokers

Traditional brokers sometimes refuse to show properties list by discount brokers or to cooperate with agents who offer reduce commission rates. This practice become evident in the

Real comp ii, ltd. V.FTCc

Case, where a mMLSrestrict visibility of listings offer by discount brokers who use nnon-traditionalbusiness models.

The federal trade commission successfully argue that these restrictions were design to protect traditional commission structures by make discount brokers’ listings punishing for consumers to find.

Market allocation: dividing territories

Market allocation occur when competitors agree to divide markets by geography, customer type, or other criteria.

Geographic division of markets

Some real estate firms have been catch agree not to compete in each other’s” territories. ” iIna notable case,

United States v. Foley

, several brokerage firms were ffoundguilty of divide a metropolitan area into exclusive territories, with each firm agree not to actively market in others’ assign areas.

The court determine that this arrangement eliminate competition and deprive consumers of competitive options in their neighborhoods.

Customer allocation

Likewise, agreements between brokers to will divide customers (e.g., ” ou take the luxury market, i’Il take first time buyers “” will constitute illegal market allocation. The

Freeman v. San Diego association of realtors ®

Case highlight how industry participants attempt to allocate different segments of the market to reduce competition.

Tie arrangements

Tie arrangements occur when a seller condition the sale of one product or service on the purchase of another.

Mandatory service bundles

Some brokerages have face antitrust scrutiny for require clients to purchase a bundle of services kinda than allow them to select exclusively those they want. In

Forsalebyowner.com v. Vennemann

, a website that help homeowners sell without agents challenge a state law that efficaciously require consumers to purchase brokerage services eventide when they want to sell severally.

The court find that this requirement constitutes an illegal tying arrangement that force consumers to pay for unwanted services.

In house services requirements

Likewise, brokerages that require clients to use affiliated mortgage, title, or insurance services may violate antitrust laws. The

Consumer financial protection bureau

Has investigated numerous cases where real estate firms pressure clients to use their affiliated service providers, efficaciously tie the purchase of real estate services to these ancillary services.

Bid rigging in real estate auctions

Bid rigging has become peculiarly problematic in foreclosure auctions and other real estate auction settings.

Source: 1investing.in

Foreclosure auction collusion

The department of justice has prosecuted numerous cases involve investors who collude at foreclosure auctions. In these schemes, investors agree not to bid against each other, unnaturally suppress the auction price. After acquire the property at a below market price, they conduct a private auction among themselves, divide the illicit profits.

The

United States v. Georgia real estate investors

Case result in multiple convictions after investors were caught on record phone calls arrange not to compete at public foreclosure auctions.

Bid suppression

In another variation, potential buyers agree to take turns being the sole bidder on properties. This rotation scheme ensures each participant get properties at unnaturally low prices without face competition. The

United States v. Northern California real estate investors

Case expose a sophisticated bid suppression scheme that had operated for years across multiple counties.

Exclusive dealing arrangements

Exclusive dealing occur when a broker or developer require clients to deal exclusively with certain service providers.

New development marketing restrictions

Some developers grant exclusive marketing rights to a single brokerage and refuse to pay commissions to buyer’s agents who bring clients to their developments. While developers can choose their list agents, blanket refusals to work with buyer’s agents can raise antitrust concerns.

In

Thompson v. Metropolitan multi list, inc.

, courts find that policies that efficaciously exclude certain classes of brokers from being able to show and sell properties violate antitrust laws by restrict consumer choice.

Information sharing and trade association issues

Real estate trade associations must be especially careful about how they share information among competitors.

Commission rate surveys

When associations collect and distribute information about commission rates, they risk facilitate price fixing. The

National association of realtors ®

Has face scrutiny for publish data that could influence members to maintain similar commission structures kinda than compete on price.

The department of justice has investigated multiple instances where trade associations share current or future pricing information that could facilitate coordination among competitors.

Standard form contracts

While trade associations can provide standardized forms as a convenience to members, they can not require their use or include provisions that limit price competition. The

United States v. Realty multi list

Case address how standardized MLS rules and forms had been used to maintain uniform commission practices.

Source: danielsgonzales.com

Recent major antitrust cases in real estate

Near settlement and commission structure changes

Follow the sitter / Burnett verdict, the national association of realtors ® agree to a landmark settlement that essentially change how real estate commissions work. The settlement prohibit list brokers from make offers of compensation to buyer brokers through mass and require more transparent disclosure of broker compensation.

This case represent peradventure the virtually significant antitrust enforcement action in real estate history, with potential damages across multiple lawsuits exceed $5 billion.

Rex real estate v. Zillow

In another significant case, discount brokerage Rex sue Zillow and the national association of realtors ®, allege that Zillow’s decision to separate non MLS listings from MLS listings on its website unfairly disadvantage Rex’s business model. Rex argues that this separation was the result of pressure fromnearr and traditional brokers to make discount brokers’ listings less visible to consumers.

While this case was finally dismissed, ihighlightsht the ongoing tensions between traditional and discount brokerage models.

Avoid antitrust violations in real estate practice

Real estate professionals can take several steps to avoid antitrust violations:

Independent commission setting

Brokers should severally establish their commission rates base on their own business models and costs, without discuss rates with competitors. Each brokerage should make its own determination about what to charge clients and what to offer cooperate brokers.

Avoid problematic discussions

Industry participants should avoid discussions about:

- Current or future commission rates

- Company policies on deal with discount brokers

- Plans to respond to new market entrants

- Agreements about which properties or clients different brokers will pursue

Proper trade association conduct

Trade associations should have antitrust compliance policies and ensure that meetings don’t become forums for anticompetitive discussions. Association leadership should stop any conversations that drift toward commission rates or coordinate responses to market competition.

Consequences of antitrust violations

The penalties for antitrust violations in real estate can be severe:

Criminal penalties

Price fixing, bid rigging, and market allocation are felonies that can result in up to 10 years in prison and fines up to $1 million for individuals or $$100million for corporations.

Civil damages

Private plaintiffs can sue for three times their actual damages (treble damages )plus attorney’s fees. As see in the sisitter buBurnettase, these damages can reach into the billions of dollars.

Reputational damage

Beyond formal penalties, firms find guilty of antitrust violations suffer significant reputational damage that can take years to overcome.

The future of antitrust enforcement in real estate

Antitrust enforcement in real estate is likely to intensify in the come years. The department of justice and federal trade commission have both signal increase interest in real estate practices, especially those relate to broker compensation.

The industry is undergone a fundamental restructuring of how commissions arnegotiatedte and disclose, with more transparent practices likely to become the norm. Technology platforms that will facilitate real estate transactions will face will continue scrutiny will regard how their policies may will advantage or will disadvantage different business models.

As the industry will adapt to these changes, real estate professionals who understand antitrust principles and will commit to fair competition will be advantageously will position to will thrive in the will evolve marketplace.

Conclusion

Antitrust violations in real estate typically involve price fixing, group boycotts, market allocation, tie arrangements, bid rigging, and information sharing that restrict competition. The recent major cases against the national association of realtors ® and large brokerages highlight the serious consequences of these violations.

For consumers, understand these violations help in recognize when they might be victims of anticompetitive practices. For real estate professionals, this knowledge is essential to maintain ethical business practices and avoid potentially devastating legal consequences.

As the industry will continue to will evolve, commitment to fair competition and transparent business practices will be essential for all participants in the real estate market.